How to be a valuable supplier for a retail chain

When I began my adventure in the FMCG sector I worked mainly with wholesale customers supplying small, independent stores. It was 2006, and there were over 100,000 such grocery stores in Poland. At that time, the organized section of the retail market accounted for only about 20% of total sales - this area was not yet well established. Retail chains have grown over time and traditional, independent stores are now in retreat. Probably because of my initial experience, I always judge the independent part of the market as healthier, more value-creating, more profitable for the overall business. From time to time I have to be convinced by someone smarter that retail chains are not pure evil and indeed, many people do believe chains offer a great opportunity - especially for small and mid-size ambitious manufacturers.

Being a supplier for a retail chain is a chance for dynamic growth. Compared to serving independent retailers, the organized chains offer a couple of advantages:

- Distribution. An agreement with one customer gives the supplier a number of stores where the products will be available

- Ease of service. There is no need to hire an army of Sales people to serve the customer. A well-experienced KAM will do the job. Nor is there any need to use a great fleet of delivery cars. One truck a day will do the job.

- Volume. Each chain store is likely to have a much higher sales potential than the average independent shop. To sell more – sell via the retail chain.

So it is actually a business opportunity, no doubt about that. The bigger the customer – the higher the value of the prize. But the risk is also greater.

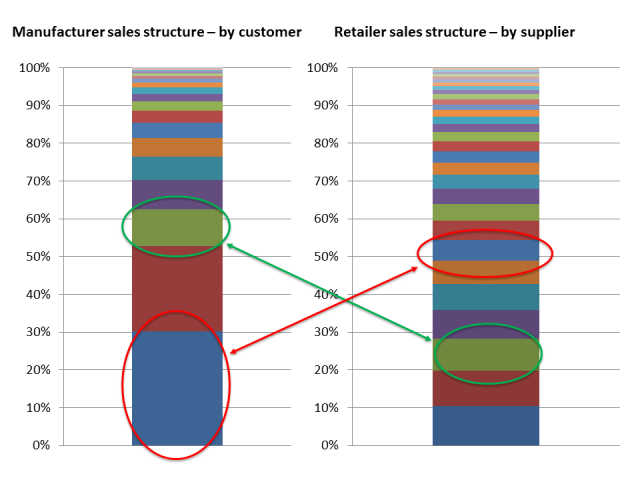

The risk can be measured quite simply by asking the question: how much is it going to hurt me if I stop supplying this customer? And how much is it going to hurt the customer? Clearly, if there is cooperation, agreement, both sides find it mutually satisfying. But in order to negotiate more for the future – there will come a time when the mutual addiction measure must be exploited by the dominating party. Each manufacturer has a number of customers generating some part of their overall business (sales/margin). In Fig. 1. this is illustrated in the chart on the left. The biggest customer generates around 30% of the business, the second biggest roughly 20% etc. The retail chain can illustrate its suppliers in a similar way showing how big a chunk of sales is generated by products according to manufacturers. Usually, the structure of the suppliers of a chain is much more uniform than the structure of the customers of a manufacturer. The reason being retail chains sell a wide range of product categories and manufacturers often sell just one category (and definitely not all). E.g. if a beer manufacturer takes 30% of the market, and sells to a customer that has 30% of the retail market, the customer is likely to account for 30% of the manufacturer's business. But from the customer's perspective, the beer manufacturer is going to generate as little as 6% of the revenue if the beer category makes up 20% of the retailer's business.

The optimal position is when the supplier generates a chunk of the retailer's business similar to the one created by the retailer in the manufacturer's business (marked green in Fig.1). The smaller the parts - the less painful the negotiations, the bigger the parts - the closer the partnership of the two businesses. In any case, they are probably addicted to one another. A more common situation, esp. among small and middle manufacturers, is domination by the retailer (marked red in Fig. 1). The supplier does not carry much weight in the business, so it’s relatively easy for the retailer to stop cooperation and find a substitute for the products. For the manufacturer, if a customer constitutes 30% of their business, it’s going to hurt really badly. This risk is even higher when a small or mid-size manufacturer delivers 'own brand' products to the chain. When this is the case, the retailer does not even lose the product when switching to a different supplier.

This kind of addiction discrepancy will definitely lead to creeping margin erosion. Every year, the customer is going to ask for better buying prices. Every year, the customer is going to get better buying prices. Unless, that is, the manufacturer is prepared to stop supplying the customer for a year (or for good). So, if you are a manufacturer aspiring to build your business in cooperation with retail chains, before closing any agreement with a big customer (bigger than you are), go through the checklist and make sure the answer to each point is “yes”:

- I can afford not to supply this customer and I have alternatives

- the agreement is secure and free of major legal and business risks

- I can deliver what I promised

And more importantly, before any round of negotiations, go through a second checklist:

- there is a clear lower limit for my selling prices and it strongly depends on the services secured by the customer. Rather than agreeing to lower my prices further, I will not sign an agreement.

- I know my value to the customer

- I know the value of my brands/products to consumers and shoppers

Only if you know your value, are you going to win. No customer will openly admit how much they care about you, so this is something you need to be well aware of.

The strong brand/product element is quite evident. If you are valuable to the consumers and shoppers – you are valuable to your customers’ customers. Your brand or product does not have to be the best seller. Even if it is only strong locally, it is the key to being made welcome. But apart from the brand, what value can you, as a supplier, offer to a retail chain? Well, that depends on the scale of your business:

- If you are one of the leading manufacturers in your category, your value to the customer is clear – your products are generating sales and shaping the assortment (the customer must have your products) and price perception. Because of the latter, your products most probably do not deliver a satisfactory margin, and this is the main topic for discussion at any meeting. The best strategy is cooperation, not based only on an agreement, but on a Joint Business Plan (JBP), as only activities well-planned in advanced have a chance of success.

- If you are a small or middle supplier…

- the customer sales generated by your products is probably not that impressive. But for the same reason the product prices are not compared that carefully between your customers which means pricing is not that aggressive. There is a good chance that your customer sells your products with a margin 10 times higher (%) than the top category products! If you are not too significant as far as sales go, you can be much better positioned in the overall margin pool.

- it is much easier to generate growth with your products. Planning any activity within a day or two is so much more straightforward than with the big suppliers. In fact, the biggest customers are mature organizations with well-established procedures and organizational charts. Depending on your scale, your main contact person can be a junior buyer, a buyer, a senior buyer, a director. If the transaction value exceeds 10k, 100k, 1M, 10M, the next person up in the hierarchy is likely to be involved and so the decision time expands from a couple of hours to a day, a week, a month, to never. If you are a small manufacturer the junior buyers will love you! They really can do business with you, every day, smoothly, without asking their boss for permission. And, by the way, they are the people in charge there.

Finally, the preferred supplier is the one who has a well-defined, transparent, and fair pricing policy. If, for any reason, the discrepancy between your largest and smallest yearly investment in a customer gets high (as a % of revenue), this will inevitably result in some conflict with your customers, internal fighting between your sellers (see one of my previous articles Release the Sales Force Superpower), and your margin is going to shrink. The reason is simple:

- the customer with the highest investment (best buying prices) is likely to reduce their selling prices

- the same customer, being also the least profitable, will quickly expand in your customer portfolio (because of the low selling prices).

- the other customers will adjust (reduce) their prices to the most aggressive chain. This price reduction shall be called “investment into pricing policy on the suppliers’ products”. A temporary measure by the retail chain. But your customer is always going to ask you for a refund.

- if any chain sets their selling prices below the buying prices of other chains – the requests for a refund will become much more aggressive and immediate.

If you spoil this part – you will think about discounting your prices more than about building your brands. This is definitely not going to help you develop a profitable business in the long-term. The things to remember about discounting, setting limits for investing in customers and negotiating are:

- the customer who asks for a higher discount does in fact ask that others receive similar funding. So you can either reduce prices for this one customer, or (effectively) increase the price for those who currently have lower prices. You have a range of tools to do so, like price lists and discounts.

- the more the chain communicates its “lowest prices in the market”, the more your investment is going to cost you. They will definitely convert your discount into their price discount, and provoke your other customers to ask you for a better bargain.

If there is a customer clearly not asking for fair treatment, but aiming for domination and better terms than anyone else, it should be an obvious signal for you to say “no” and stop supplying them - at least for a while. If you claim this is impossible, it means that you are already fatally addicted to the customer and you are on your way to killing your business profit pretty soon by continuing to work with them. You'd better realize it is in fact possible and think of a backup plan, how to extract some value from terminating cooperation with a retail price aggressor. Your other customers will love it. Play it right.

Image source: unsplash.com