Third player syndrome and how to deal with it

Is your business a successful FMCG company? Are you the top player in the market or perhaps the number 2 with a high market share? Are you one of the price leaders? Are your margins fat and growing? Is your motivation and compensation system generous? Congratulations. You are about to be attacked.

All the symptoms above suggest that your business is still operating in an immature market, or at least an immature section of it. Fat margins and a high market share (dominated by one or two players) probably mean that you entered the market in its early stages and seized a great chunk of the sales and profit pool. You succeeded because you were one of the first players prepared to reach for the prize. You were definitely better than some of the other guys. Now you are enjoying your success. But are you anticipating any aggressive behaviour from minor players in the market? Are you ready to deal with it? If your only concern is how to spend your planned budgets on conferences with customers and the employee bonus program, and your strategic plan is based on the extrapolation of current trends – probably not. You are extremely vulnerable to attack from someone flexible and small enough to dodge their own ricochet bullets, an assault from someone who has estimated the margins, is ready to adapt and enters the game with an incomparably lower level of fixed costs.

In fact, during a price war, the leader is usually the most exposed business. Apart from their scale, that should give them more power in negotiating and to retaliate, strategy analogies between military war and commercial price battles do not work so well. In fact, size does not necessarily make you stronger, but it is true that the bigger you are, the easier you are to hit.

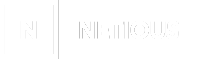

I've prepared an illustration of this attack. Fig. 1. shows an immature market with two dominating players and one smaller insignificant (though let's say aspiring) contender. One of the players introduces some expansion mechanics onto the market. More sophisticated players would innovate, while those taking a straightforward approach would simply reduce prices. For the sake of simplicity, we can assume here that this is a blind attack, i.e. the attacking business has not prepared the proper market segmentation in order to strike at the competitors’ strongest domains rather than their own. In this case, the expansion mechanism is likely to gain shares uniformly from the existing market. Why don't we take a look at the numbers (should you get tired just head straight to the conclusions!), and assign exemplary values to the market structure:

- Business A starting with a 50% MS

- Business B starting with a 45% MS

- Business C starting with a 5% MS

Let us also assume that the expansion mechanism has a 10% overall market share potential. In which case it's going to take 5 p.p. from Business A, 4.5 p.p. from Business B, and 0.5p.p. from Business C, i.e. 10% of their starting position.

Does this mean that the effect is the same irrespective of who introduces the mechanism? Not at all. If we consider three separate cases (exclusively, i.e. only one happens at a time), where each business in turn introduces the expansion mechanics we see that:

- Case 1: Business A attacks. The final MS of Business A is 50% - 5% + 10% = 55%. The relative sales growth is (55%-50%)/50% = +10%.

- Case 2: Business B attacks. The final MS of Business B is 45%-4.5%+10% = 50.5 %. The relative sales growth is (50.5%-45%)/45% = +12.2%.

- Case 3: Business C attacks. The final MS of Business C is 5%-0.5%+10% = 14.5% The relative sales growth is (14.5%-5%)/5% = +190%!

Conclusion 1: the smaller the business, the higher relative growth it can generate by attacking the others.

Let us now assume, that the expansion activity is a price-driven attack, and the Gross Margin (before any fixed costs) at the beginning equals 40% for all players. If the sales in the entire market equal 100 (arbitrary units, arbitrary time period), then Business A generates gross profit of 20, Business B generates 18, and Business C generates 2. Let's also assume, that the price attack is fairly sophisticated, so it’s not a price reduction across the board, just the introduction of a new product with a 20% margin (if the variable costs reflect the average – this margin level would be equivalent to price positioning at 25% below the average, so nothing too drastic). The new margin would be:

- Case 1: New gross profit of Business A equals 100 x [(50%-5%)x 40% + 10% x 20%] = 20. No change.

- Case 2: New gross profit of Business B equals 100 x[(45%-4.5%)x40% + 10% x 20%] = 18.2. 1.1% growth.

- Case 3: New gross profit of Business C equals 100 x[(5%-0.5%)x40% + 10% x 20%] = 3.8. Growth by 90%!

[Note: In all cases the overall market gross profit equals 100 x [(100% - 10%) x 40% + 10% x 20%] = 38, so it has been reduced by 5% due to an average 2.5% reduction. To hope for the category to grow, so that at least the profit pool is untouched, the overall category price elasticity would have to be below -2.1. Not something that happens often. So price wars usually damage profits across the entire industry.]

Conclusion 2: The smaller the business, the easier it is to generate profit growth by (price) attacking the others.

In reality, price attacks are not that sophisticated and rarely is it possible to keep the core business profitability untouched. The effect would then be much worse, and even in the given scenario the biggest player in the market is merely defending their profit level when attempting to price attack the market. The minor player is the one who poses the most significant threat to the others, and it’s generally the third player who has sufficient power to enter the fight. Moreover, they definitely have the right motivation to do so. Many businesses are so convinced of their strength that they’ve ignored the threat even when the war is already underway. That same business then loses half of their yearly profit within 3-5 years.

Is it possible to prevent price wars? Or to minimize the damage once the battle has commenced? It is, but it’s necessary to change the organization mindset, structure, and make certain the business is flexible enough to react quickly.

Critical area: allocate appropriate resources

In every area of business, it is vital to allocate the right resources if you are to remain ahead of the competition. The issue with a price war is that resources should be assigned before it actually begins. In a “winning” organization, finding the funding to prepare for war may be very difficult (as hardly anyone recognizes the need), yet it is absolutely necessary. There are a couple of areas where such an investment in resources is guaranteed to pay off later:

- Business intelligence. You cannot afford to hire poor employees. As a leader you need to attract and retain the most talented people. Yes, this will be expensive, but it’s the only way keep track of the market trends, and sound the alarm when the need arises. If your BI team only reports your success and ignores the competitors – you've hired the wrong team.

- Brands. The only real value that does not need to be discounted are your brands. Strong brands can justify their price. Strong brands are something your customers must have, so you do not need to give the discount away instead. Hire the best brand marketing team. Equip them with the most up-to-date tools. Invest in their development. Invest in the best practices so that the marketing money is spent effectively. Fuel the brand investment.

- Sales Force. Develop the core Sales Team capabilities. They cannot simply remain the representatives of the absolute leader, who dictates how the market should look. Make sure they know how to sell and manage customers profitably. Prepare an appropriate motivation and compensation system for them (see my previous article “Release the Sales Force Superpower”) that will see you through the tough times. In the leading organizations, the Sales Force loses strength and is lulled into a false sense of security by the company's success.

Once the price war starts, it’s not going to get any easier to find these resources. The need has been recognized, but the organization, exposed to attack, and taking painful hits, is already seeking savings to deliver ambitious targets. And the first cuts will be in marketing and recruitment (I bet). Inevitably, such savings will end up making the business even more vulnerable.

The later you respond – the more you lose

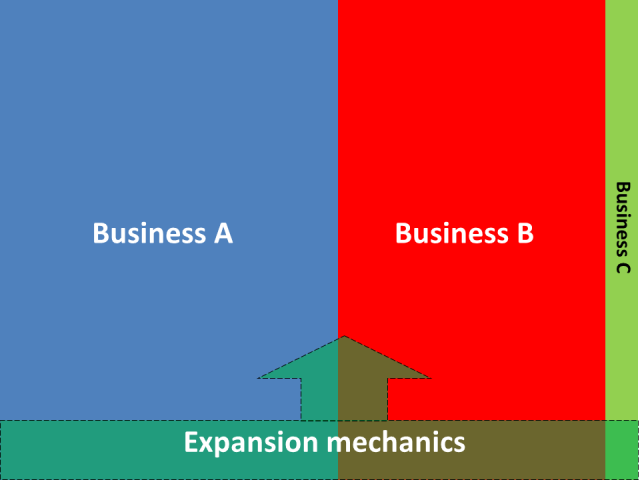

Sooner or later, the organization needs to admit that ignoring the signals from the market is a bad idea, and it’s high time to invest and sacrifice some of the margin. The sooner, the better. There are couple of reasons why:

- The scale rate of the attacking and defending businesses reflects the investment required to protect the defending business's position, as a % of yearly revenue. e.g. if the defending business has 50% of the market share, and the attacking business 5% - it should be possible for the first to re-program only 1/10 in order to neutralize the attack. After a while of ignoring the threat, both may have the same scale, e.g. 33% of market share. Then the entire business needs to be fighting. The cost of defending the market position grows with time.

- Each lost p.p. of market share has long-term and cumulating consequences. If sales drop, profits are definitely not going to increase, esp. during a price war. The smaller the scale, the less fuel (cash) is available to feed the warfare. Finally, a higher accumulated loss in profit.

These two effects add up, giving the cost of a delayed reaction. It is schematically illustrated in Fig. 2.

So, how to deal with an aggressive third player?

There are some principles that are applicable, perhaps not all would suit every business, or not at every stage of the war, but here they are.

Respond selectively to local attack

Every strong market player has a weak point somewhere. There might be some market domains where the third player is actually the first, and the national leader ranks third - here the big guy has all the advantages that the small guys have on a national level. Try to seek (a) geographical domains, (b) consumer segments where this is the case, and attack there. The best method is to clamp down on the competitor's source of easy cash without harming yourself too much. The more selective you can be, the more effectively your program will work. Responding selectively works well at all stages of the price war, as long as you can identify the market domains dominated by your competitors. So it should be much easier to switch on at a later stage, when you have already lost a valuable part of the market. At all costs, avoid general widespread methods, such as a national price list – level discounting. It’s dead expensive and too transparent for your competitors to read.

Just a note on this selective attack. Some companies tend to confuse what’s selective and what’s complementary. Geographical domains are selective, as their boundaries are well-defined and fixed. In every local market one needs to take over the leadership, and this does not influence other local markets to any great extent (I mean here the consumers and shoppers, NOT the retailers or distributors). Similarly in consumer segments. If segmentation is done properly, the groups are pretty stable. Or at least no business activity can switch consumers between segments. Attacking in one segment will thus not have a significant effect on other consumers. Sales channels are a completely different dimension as they are complementary, and focusing on one channel more than another does not have much to do with selective attack. To be more specific – the boundaries between channels are sensitive to the investment. If a product is discounted in one channel only, not only does its share in this channel grow, but sales in other channels decline. If there is strong investment in a channel for a specific category, all the other channels simply shrink. Moreover, investing in channels is highly visible to your competitors, as your customers will communicate it. There is no better argument in negotiating a higher discount than “your competitor has just lowered their prices for us, so how about you?”. Once you think channel-wise, you’ll drive a negative mix by (a) reducing profitability of selected channels, and (b) funding the growth of the least profitable ones. If well-planned, this operation might indeed give some incremental profit, but for a market leader it’s very tricky.

Re-design your organization structure to gain flexibility

The whole is greater than the sum of its parts. This happens to be true in some situations, like negotiating with suppliers and customers, or using the Sales Force effectively to build new product distribution. But during a price war the whole turns out to be smaller than the sum of its parts. Why is that? Imagine that there are 20 manufacturers in a given category in the market, each delivering one product, each holding 5% of the market share (see Fig.3.). The only difference is that they address their products to various consumer segments. One of the manufacturers (“A” in Fig. 3) attacks the others by discounting the product price. Not all of them will suffer in the same way. This strongly depends on how close the target consumer segments are. So, business “K” is to lose the most, “B” and “L” will be hit quite severely, while businesses “E”-“J” and “O”-“T” remain fairly healthy. Irrespective of the damage, each of these small businesses can respond quickly and quite securely. Quickly, because their size means they are flexible, and securely, because they are small, any reaction will hit all the others rather than the business responding. So, “K” might become quite angry, and counter-attack with heavy artillery. The same might be done by other businesses that have lost visibly. The effect will be two-fold. First, business “A” will see that price-driven attacks do not pay off and the response comes quickly. Second, other businesses will defend their position. It's going to cost, but if their response was delayed then business “A” would actually learn that price attacks are the right tools for expansion, and the harm caused to other businesses would be much bigger. Nobody is going to wait.

Now imagine, that the same picture shows products, not businesses, and products K-T are owned by one manufacturer, the market leader. An attack by discounting a competitor’s product - “A” - would be definitely harmful for the leader. However, it would take big organizations a fair while to notice that products “K”-“N” are in decline because of an attack from a competitor (many projects, many priorities). Then it would take weeks or months of debates, analyses, misalignment and postponed meetings before the decision to respond is finally made. And the response would most probably be inadequate to the attack anyway. This is because such portfolio thinking forces the board to worry how much other products would be harmed by the response of “K”. To make sure the rest of the business is secure, any action taken is likely to be mild, hence inappropriate.

The price war organization chart will of course be different to the one in immature markets with fat margins and domination. Use your scale where it works for you. But the brand and product management teams should give individual product or brand managers the power to make decisions. They should be able to respond quickly and take decisions without the need to bring every detail to board meetings. They should be also very capable so as not to destroy the business (and this is why you need to invest in resources). Finally, they should be, to a certain extent, selfish, and not worry about cannibalizing other products if they have to. Because if they do hesitate at this point – your competitors won't have any qualms and they'll launch an attack instead.

Image source: Chess Kings and knight winning by Andreas Kontokanis